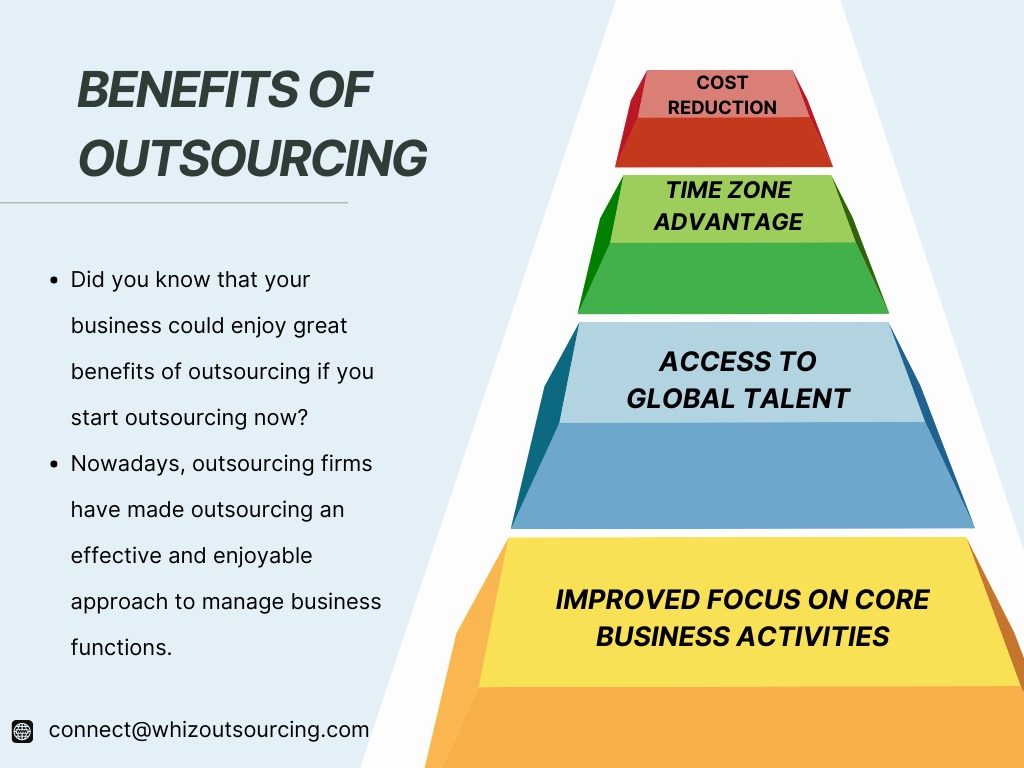

Did you know that your business could enjoy great benefits

of outsourcing if you start outsourcing now? In the past, business owners would try to manage all the functions of their businesses. They did not consider that the excess strain caused so much unproductivity.

Here we are bringing the key measures that will take effect from April 2023.

At the Mini Budget in September, the government announced a plan to abolish the 45% additional rate of income tax from April 2023. It was announced on 3 October 2022 that the government would not proceed with this plan.

There are several reasons why organizations might choose to hire young professionals

Fresh perspectives: young professionals bring new ideas and innovative thinking to the workplace. They bring a fresh perspective to problem-solving and can challenge established ways of doing things.

MTD Keeping records digitally versus manual records

HMRC believe that records maintained manually and not digitally contain more errors. As a result, this causes HMRC a loss in tax Revenue. HMRC believe that the changeover to digital records will reduce the errors filed and therefore increase the tax collected.

MTD stands for Making Tax Digital, which is an initiative introduced by HM Revenue and Customs (HMRC) in the United Kingdom.

MTD aims to transform the UK tax system by digitizing and streamlining the process of record-keeping and tax reporting for businesses and individuals.

Self-Assessment customers can help themselves by filing their tax return early

The Self-Assessment deadline for the 2022 to 2023 tax year is 31 January 2024 but there are many benefits to filing earlier.

DATA Security

Data security is a critical requirement for an accounting firm due to the highly sensitive nature of financial, personal, and business data it handles.

Australia

Australia

UK

UK

USA

USA